doordash business address for taxes

1 Best answer. The employer identification number.

How Do I Contact A Doordash Driver

Whether blatant or hidden barriers to success have no place at DoorDash.

. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. Paper Copy through Mail. Choose the expanded view of the.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. DoorDash will file your 1099 tax. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate.

Your biggest benefit will be the. We value a diverse workforce people who identify as women. We dont get a w2.

We get a 1099. A 1099 form differs from a W-2 which is the standard form issued to. There are four major steps to figuring out your income taxes.

You can claim your mileage you drove for doordash but you will most likely owe money at tax time unless you havehad a w2 job also. It may take 2-3 weeks for your tax documents to arrive by mail. DoorDash will provide its earnings and that earnings will be presented on the 1099-NEC form.

Income from DoorDash is self-employed income. The forms are filed with the US. You are considered as self-employed and in IRS parlance are operating a business.

All tax documents are mailed on or before January 31 to the business address on file with DoorDash. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Is 1099 not w2.

In order to evaluate if Doordash is worth it after Taxes we need to evaluate the tax calculations and numbers in details. You will pay to the Federal IRS and to the State separate taxes. Ad Talk to a 1-800Accountant Small Business.

This means you will be responsible for paying your estimated taxes on your own quarterly. Lets assume you work for Doordash for 40 Hours a week. March 18 2021 213 PM.

All you need to do is track your mileage for taxes. Please allow up to 10 business days for mail delivery. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

Reduce income by applying deductions. Add up all of your income from all sources. Please search your inbox for an email titled Action required to receive your DoorDash 2022 tax form.

Calculate your income tax. 6 rows Doordash Inc. A 1099-NEC form summarizes Dashers earnings as independent.

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash. This means that DoorDashers will get a 1099-NEC form from DoorDash. Is a corporation in San Francisco California.

Keep your restaurant taxes organized Small business owners. BUSINESS ADDRESS EIN 462852392 An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. As a Dasher you are considered a.

Since DoorDash earnings are treated essentially the same. Paper Copy through Mail. Internal Revenue Service IRS and if required state tax departments.

462852392 Ein Tax Id Doordash Inc San Francisco Ca Employer Identification Number Registry

How Do Food Delivery Couriers Pay Taxes Get It Back

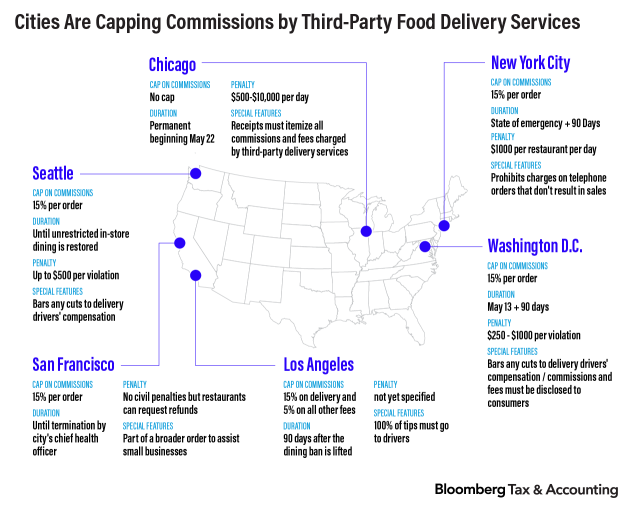

Doordash Pushes Back Against Fee Delivery Commissions With New Charges

What Is An Ein And How Do I Get One Nextadvisor With Time

How To File Taxes As An Independent Contractor Everlance

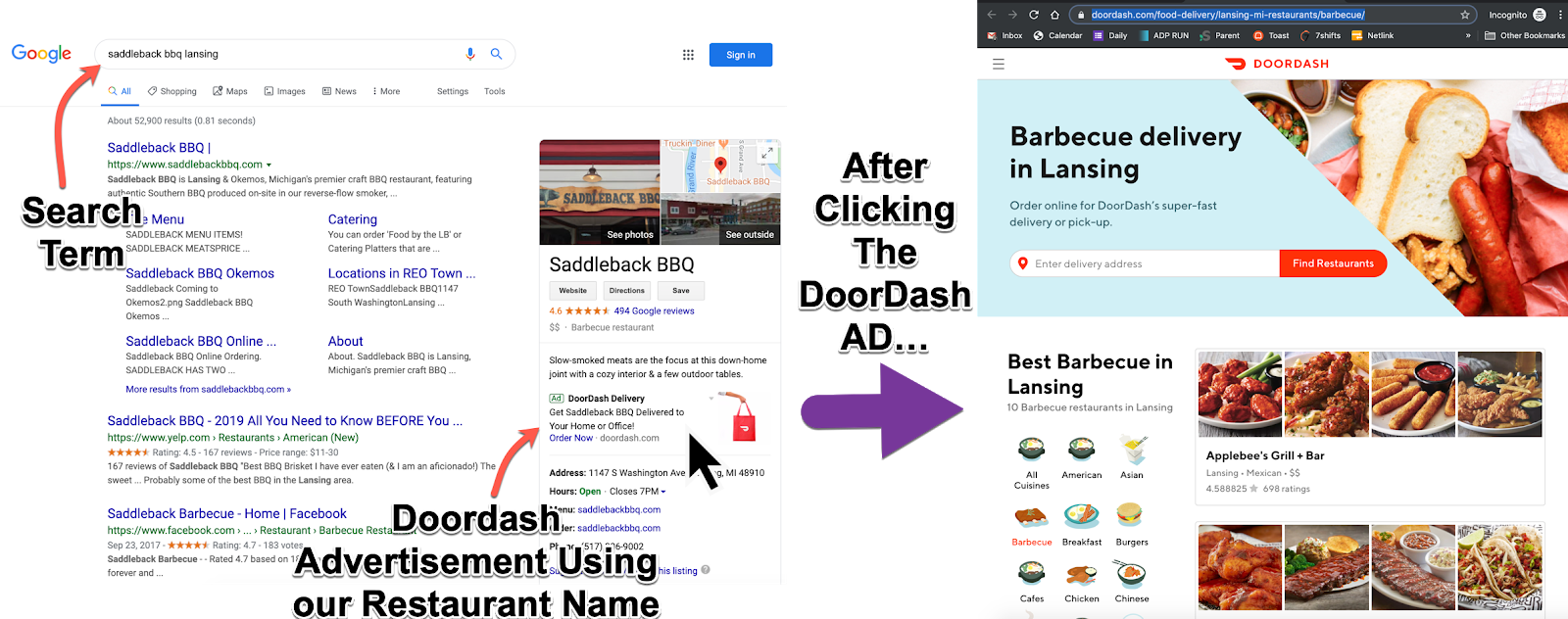

How Google Doordash Grubhub Conspire To Screw Local Restaurants Saddleback Bbq

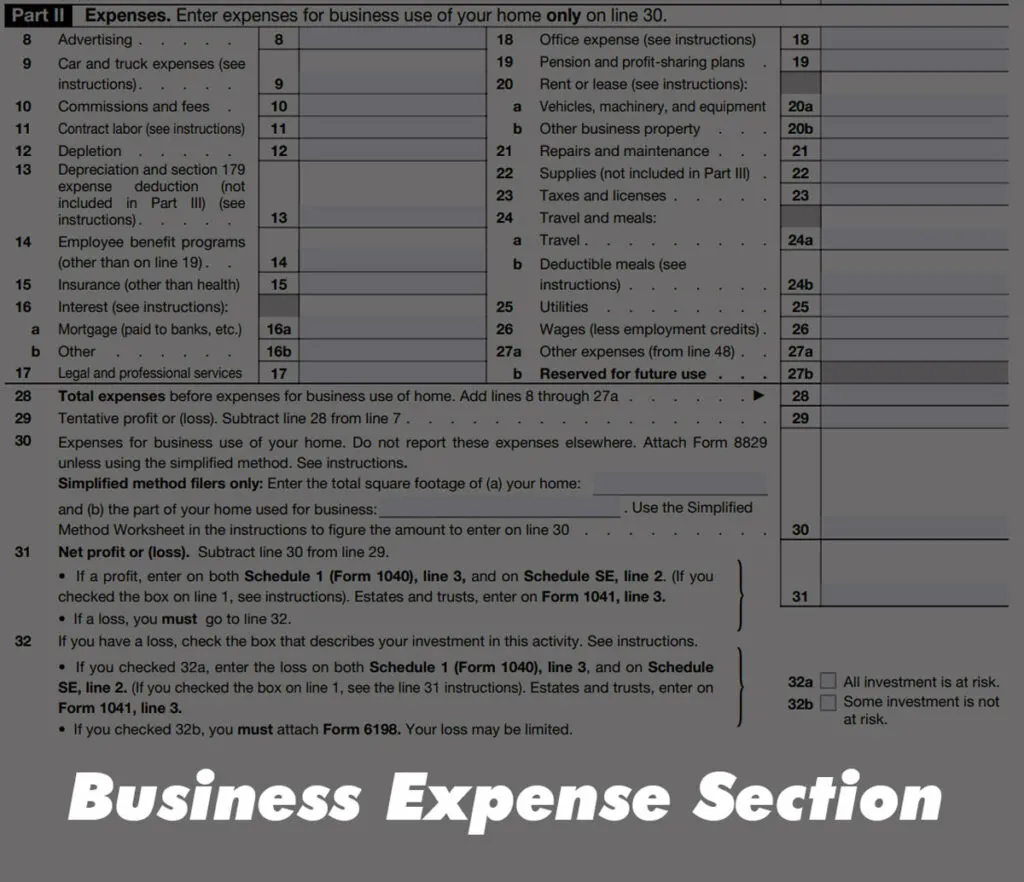

How To Fill Out Schedule C For Doordash Independent Contractors

Doordash Driver Canada Everything You Need To Know To Get Started

Dollar General And Doordash Announce Partnership To Offer On Demand Delivery Of Everyday Essentials Business Wire

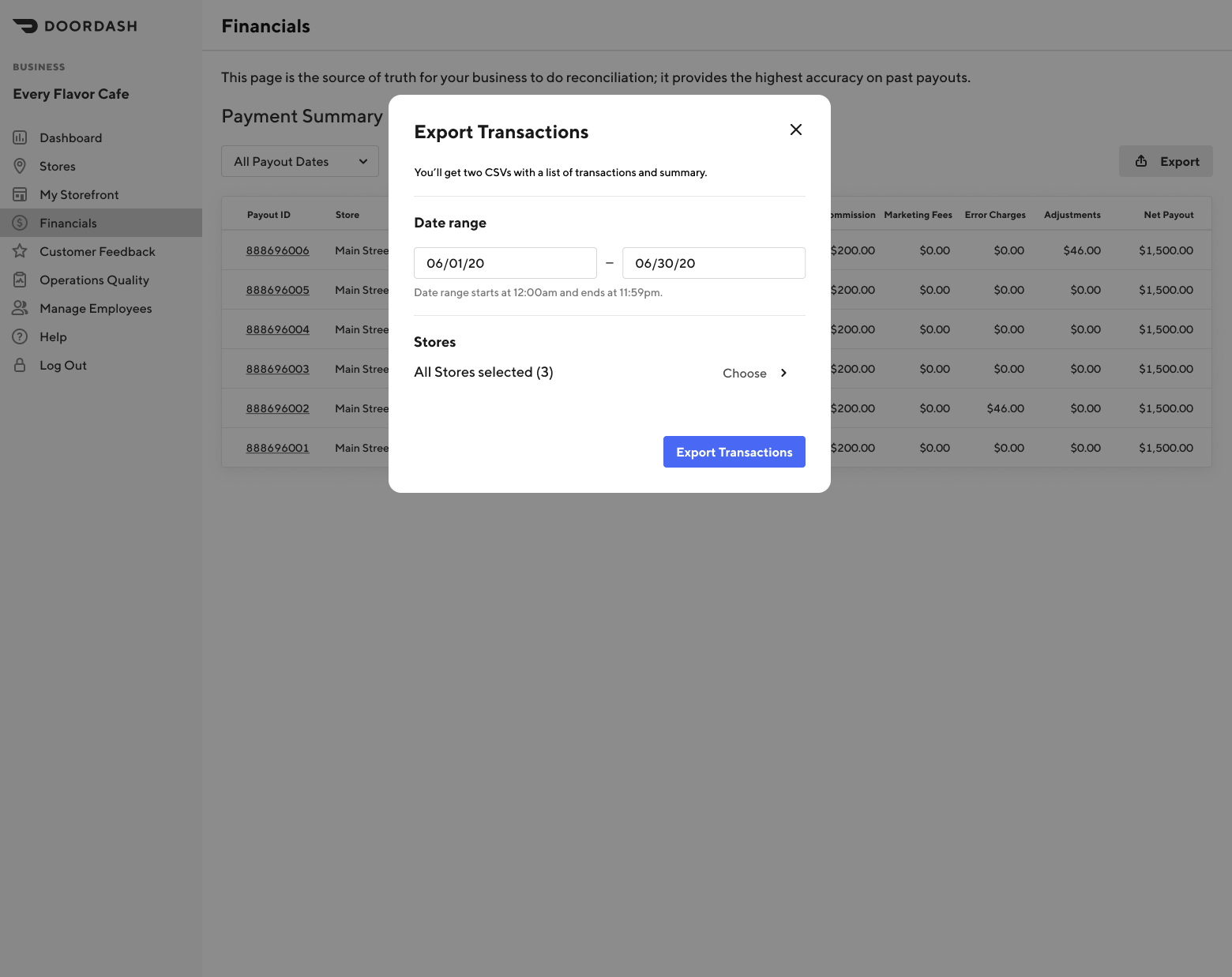

Prepare For Tax Season With These Restaurant Tax Tips

How To Get Your 1099 Tax Form From Doordash

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Audit Risks Emerge For Doordash Grubhub And Uber Eats

Managing Your Sales Tax With Grubhub Doordash And Uber Eats On Your Pos Total Food Service

Doordash 1099 How To Get Your Tax Form And When It S Sent

How To File Doordash Taxes Doordash Drivers Write Offs

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax